Chibougamau,

QC

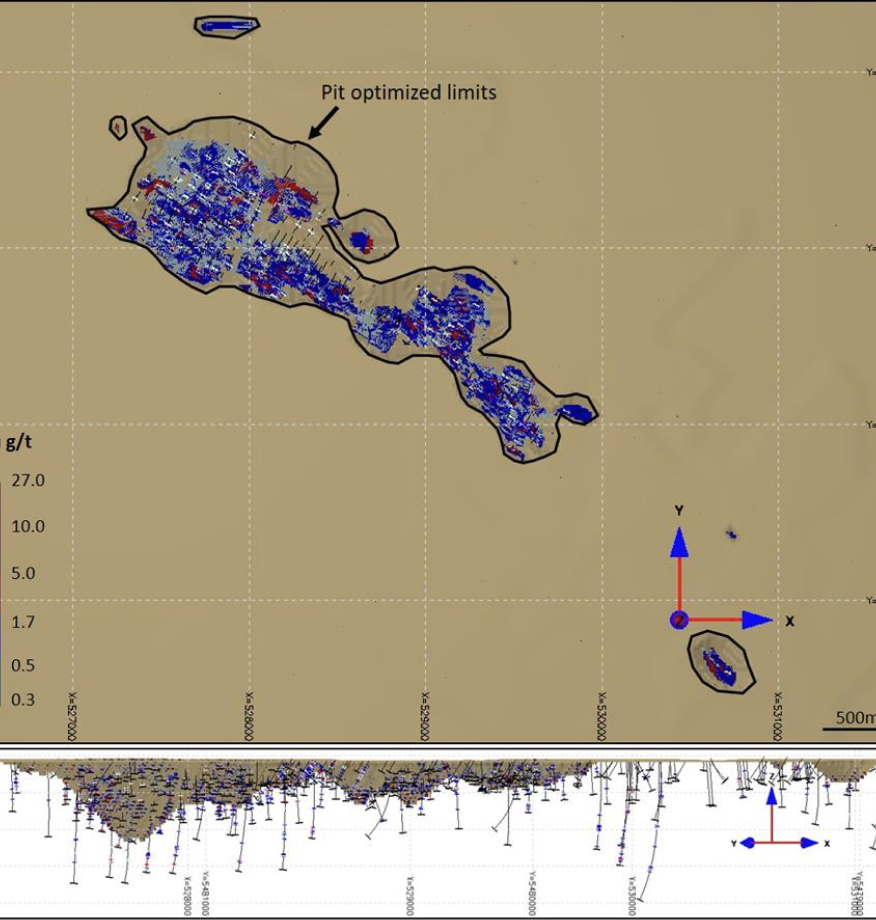

Guercheville Fault Zone

and central to many of the project with already defined resources we believe Philibert will become a pilar in the camp.

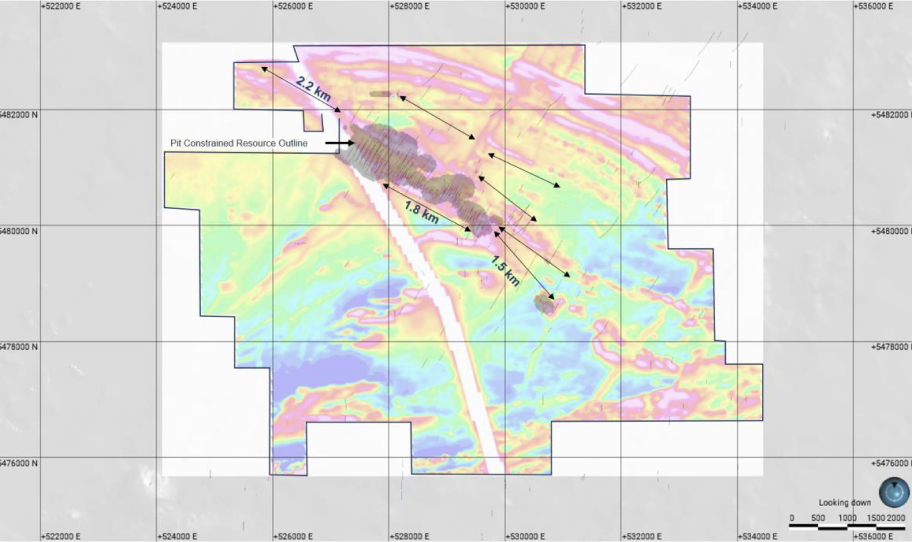

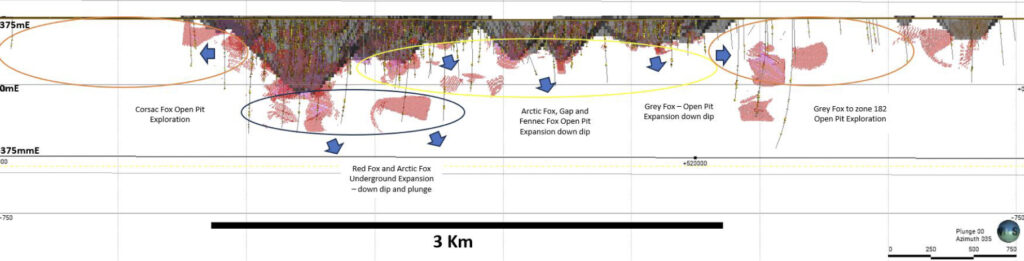

3 km trend defined

Near surface gold defined over 3 km with huge upside potential for expansion along strike, down dip and down plunge.

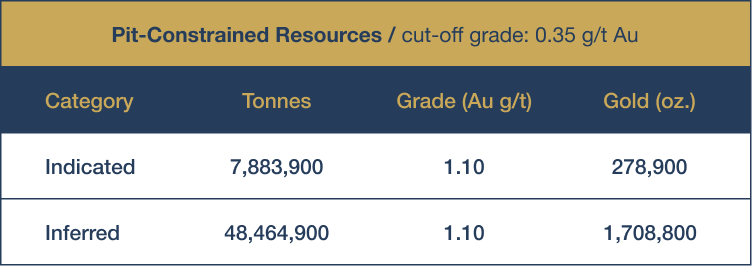

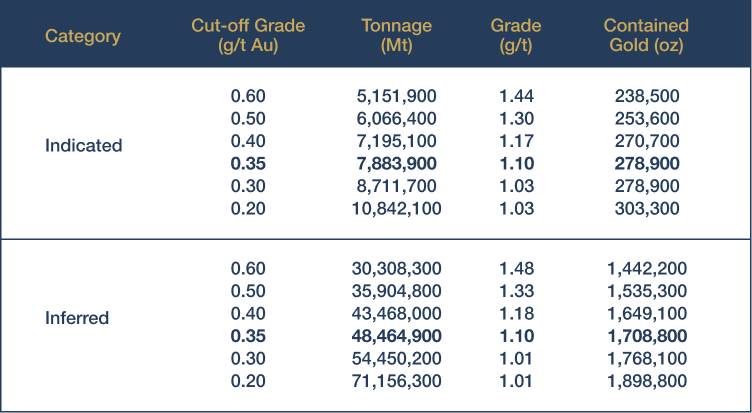

Recent Maiden 43-101 Resource

Indicated: 278,000 oz at 1.1 g/t

Inferred: 1,708,800 oz at 1.1 g/t

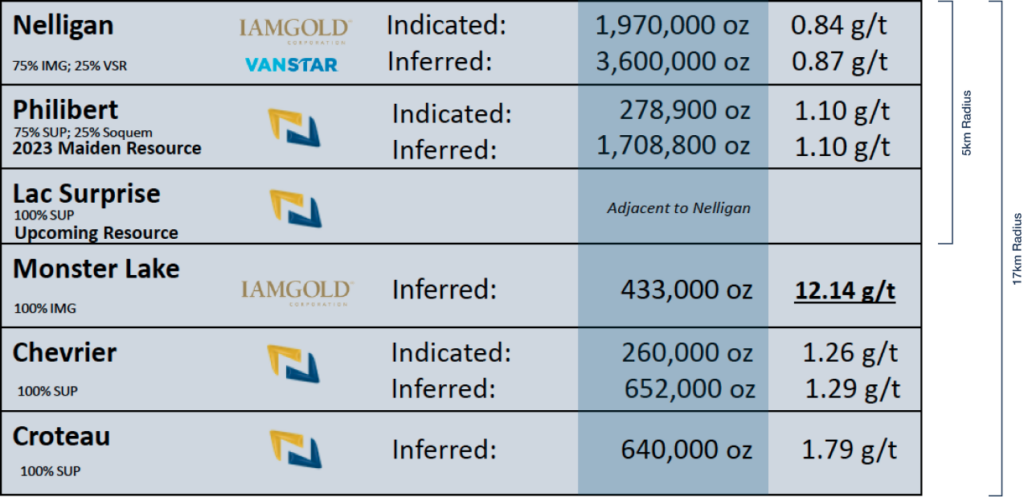

Leading the Consolidation of the Chibougamau Gold Camp

By consolidating the most relevant gold deposits in the Chibougamau Gold Camp under one roof, Northern Superior is increasing the viability of the resources. The deposits are located within a small radius, which will eventually allow them to be combined into a single operational design, feeding a single mill.

We look at the camp as one project.

Benefits of Exploration in Chibougamau

Following it’s long history of copper driven exploration, it has become evident that the southern Chibougamau camp has been largely overlooked for gold mineralization and this is why we believe several major gold deposits and important discoveries are inherent to this area.

Our properties are near or even adjacent to Nelligan, which was the “Discovery of the Year” in 2019.

This area is a Tier 1 mining jurisdiction. All properties are accessible by road and have nearby access to hydroelectricity.

Quebec is one of the most sought after jurisdictions in the world with unmatched government support.

Monster Lake – NI 43-101, May 2018; Nelligan NI 43-101, February 2023; Chevrier NI 43-101, September 2022; Joe Mann Cumulative Production in 2001, SIGEOM

Initial Mineralization of 3 km

Positive Metallurgical Testing With Flotation Concentrate Recoveries up to 95.6%

- Arctic Fox South zone with 95.6% of the gold in 9.5% of mass;

- Arctic Fox North zone with 93.3% of the gold in 13.2% of mass; and

- Red Fox zone with 95.5% of the gold in 15% of mass.

Mineral Resources are reported at a cut-off grade of 0.35 g/t Au for the pit-constrained. This cut-off is calculated at a gold price of US$1,746.58 with an exchange rate of 1.3 US$/C$ per troy ounce. The pit-constrained resources were based on the following parameters: mining cost 3.25$/t, processing, transport + G&A costs $15/t, Au recovery 93%, bedrock slope angle of 45 degrees. The mineral resource presented here were estimated with a block size of 5m X 5m X 5m for the pit-constrained. The blocks were interpolated from equal length composites calculated from the mineralized intervals. Prior to compositing, high-grade gold assays were capped to 26.74 g/t Au applied on 1-meter composites for the pit-constrained. The mineral estimation was completed using the inverse distance squared methodology utilizing three passes. For each pass, search ellipsoids followed the geological interpretation trends were used. For passe 1 and 2 a minimum of 4 composites and maximum of 12 composites with a maximum of 3 composites from the same drillhole (a minimum of two drillholes are needed to estimate each block). For passe 3 minimum of 3 composites and maximum of 6 composites were used. The Mineral Resources have been classified under the guidelines of the CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council (2014), and procedures for classifying the reported Mineral Resources were undertaken within the context of the Canadian Securities Administrators NI 43-101. The classification using a minimum of three drillholes within 30 metres of each other or less defines indicated resources. The inferred resources were classified using 1 pass extends by a maximum of 120 metres and 30 metres thick using one drillhole with a minimum of 2 composites. In order to accurately estimate the resources, the claim limits were taken into consideration for the pit optimization. Tonnage estimates are based on rock densities of 2.8 tonnes per cubic metre for all the zones. Results are presented undiluted and in situ and numbers are rounded to nearest hundred. Numbers may not total due to rounding. The metal contents are presented in troy ounces (tonnes x grade / 31.10348).

Philibert

Obvious Potential to Expand:

- IN-PIT by CONVERTING waste to ore

- RemainsOPEN down dip and plunge within pit contained resource

- On ANOTHER4 kilometres along strike

- Potential for parallel zones to REPLICATE the Philibert mineralization to the North

Strong magnetic signature associated to mineralized gabbro host and part of the structural splay off the Guercheville Fault Zone